Investment instruments

Investment instruments

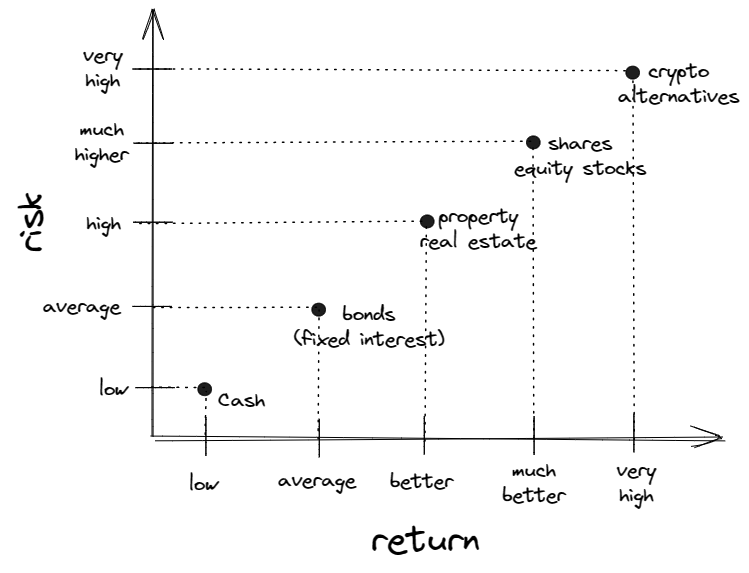

Cash

Cash is often considered one of the safest investment options because it is highly liquid and not subject to market fluctuations. It’s not affected by stock market volatility or economic downturns. This makes it a low-risk option, as the value of your cash holdings is relatively stable.

However, the trade-off for this safety is that cash typically provides relatively low returns compared to other investment options. When you hold your money in cash, whether in a savings account or as physical currency, it doesn’t generate much income on its own. In most cases, the interest or return you earn on cash is lower than what you could potentially earn by investing in other assets like stocks, bonds, or real estate.

Bonds

Bonds are often considered a moderate-risk investment option. When you invest in bonds, you’re essentially lending money to a government or corporation in exchange for periodic interest payments and the return of your principal amount at maturity. The risk associated with bonds comes from the potential for the issuer to default on these payments. However, compared to stocks or other higher-risk assets, bonds are generally less volatile and have a more predictable income stream. This makes them an option with average risk.

Bonds typically provide investors with a relatively stable and predictable source of income through periodic interest payments (coupon payments). The return on bonds is often considered average because it falls between the low returns of cash and the potentially higher returns of stocks. The exact return on a bond depends on factors such as its coupon rate, maturity date, and prevailing interest rates in the market. Generally, investors can expect to earn a return that is modestly higher than what they might earn from holding cash.

Property or Real Estate

Real estate investments can carry a higher level of risk compared to some other investment options. This risk can come from various factors, including market volatility, economic conditions, location-specific risks, and property management challenges. Real estate markets can experience fluctuations, and property values may not always appreciate as expected. Additionally, property investments may require ongoing maintenance and management, adding to the potential risks.

Despite the higher risk, real estate has the potential to offer better returns compared to lower-risk assets like bonds or cash. Real estate investors can generate income through rental payments, and property values can appreciate over time, providing capital gains. In some cases, real estate investments can outperform traditional assets over the long term, especially in growing or high-demand markets.

Shares or Equity Stocks

Investing in shares or equity stocks is often associated with much higher risk compared to other investment options. Several factors contribute to this increased risk, including market volatility, economic conditions, and company-specific factors. Stock prices can fluctuate significantly in response to market feeling, news, and events, leading to potential short-term losses. Additionally, individual companies can face financial challenges or even go bankrupt, resulting in a complete loss of investment in that stock.

The trade-off for the higher risk associated with stocks is the potential for much better returns. Historically, stocks have delivered some of the highest long-term returns among various asset classes. Over time, stock markets tend to appreciate, and investors can benefit from capital gains as stock prices increase. Furthermore, many companies distribute dividends to shareholders, providing an additional source of income. Over the long term, the combination of price appreciation and dividends can result in substantial returns.

Alternatives or Cryptocurrencies

Investing in alternatives, particularly cryptocurrencies like Bitcoin and Ethereum, is associated with very high levels of risk. This heightened risk is due to several factors. Cryptocurrencies are highly volatile, and their prices can experience extreme fluctuations over short periods. Regulatory uncertainty in many countries adds to the risk, as governments may impose restrictions or regulations on the use and trading of cryptocurrencies. Additionally, the lack of a centralized authority means there’s no recourse for investors in case of fraud, hacking, or loss of access to digital wallets.

The attraction of cryptocurrencies lies in their potential for very high returns. Historically, some cryptocurrencies have witnessed astonishing price growth, leading to substantial profits for early investors. The decentralized nature of cryptocurrencies and their limited supply contribute to the perception of scarcity, which can drive up prices when demand surges. Investors who entered the cryptocurrency market during its early stages have seen significant returns on their investments.

Types of portfolio

Income Portfolio

An income portfolio is tailored for investors seeking a balance between steady returns and minimal risk. It primarily consists of dividend-paying stocks and coupon-yielding bonds, making it suitable for those with a short- to midrange investment horizon.

Key Characteristics

-

Asset Allocation: Income portfolios are typically composed of a significant allocation to bonds, often 100% bonds, or a mix of stocks and bonds, such as 20% stocks and 80% bonds or 30% stocks and 70% bonds.

-

Risk Tolerance: Investors comfortable with minimal risk find income portfolios appealing. This approach prioritizes stability and income generation.

-

Tax Considerations: It’s important to note that depending on the specific account, the dividends and returns from an income portfolio can be taxable, which is a factor to consider when assessing the overall return.

Balanced Portfolio

A balanced portfolio strikes a middle ground between risk and potential return by investing in both stocks and bonds. This approach is suitable for investors who can tolerate short-term price fluctuations, seek moderate growth, and have a mid- to long-range investment horizon.

Key Characteristics

-

Asset Allocation: Balanced portfolios typically consist of a combination of stocks and bonds, with various allocation ratios. Common allocations include 40% stocks and 60% bonds, 50% stocks and 50% bonds, or 60% stocks and 40% bonds.

-

Risk Tolerance: Investors seeking a balanced portfolio are comfortable with some degree of risk and are willing to weather short-term market volatility in exchange for the potential for moderate growth over time.

Growth Portfolio

A growth portfolio is designed for investors seeking significant long-term capital appreciation. It primarily consists of stocks expected to appreciate over time, but it also comes with the potential for substantial short-term price fluctuations. Investors in a growth portfolio typically have a high risk tolerance and a long-term investment horizon, with generating current income as a secondary objective.

Key Characteristics

-

Asset Allocation: Growth portfolios are heavily weighted toward stocks, with minimal exposure to bonds. Common allocations include 70% stocks and 30% bonds, 80% stocks and 20% bonds, or even 100% stocks.

-

Risk Tolerance: Investors in a growth portfolio are comfortable with high levels of risk and are willing to withstand significant short-term market volatility. They prioritize long-term wealth accumulation over current income.